Formulaires disponibles Vat europe check

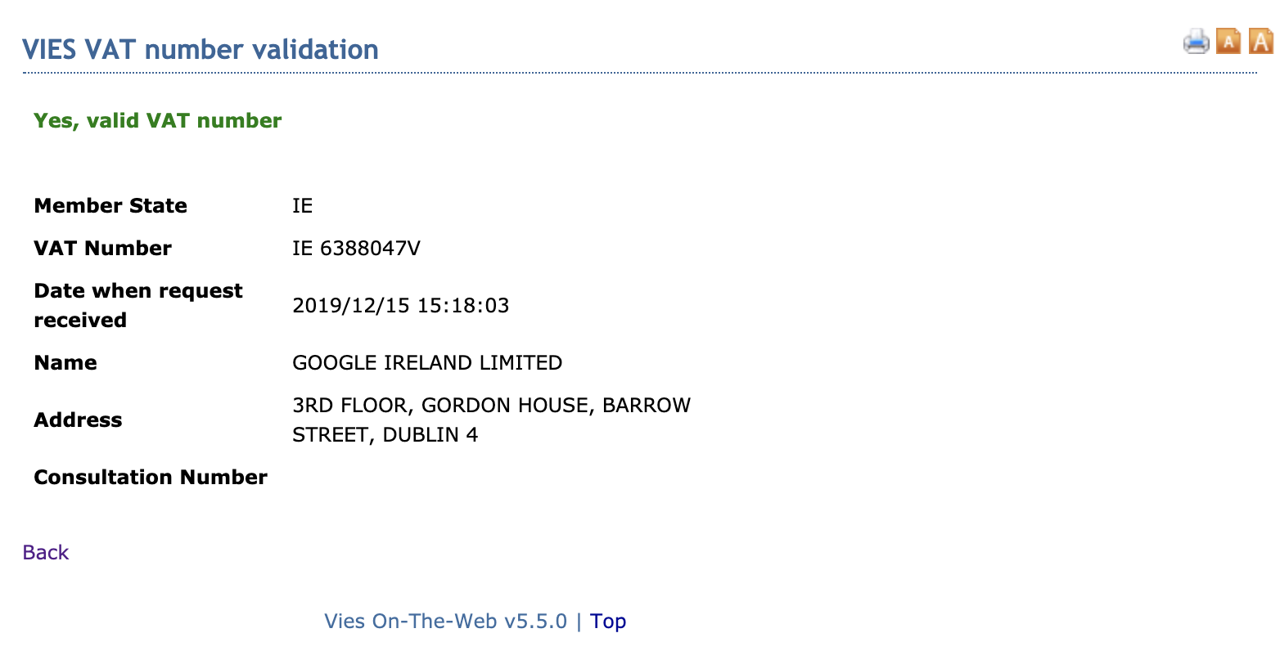

VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission. The data is retrieved from national VAT databases when a search is made from the VIES tool. The search result that is displayed within the VIES tool can be in one of two ways; EU VAT information exists ( valid) or it doesn't exist.

How to Check and Validate EU VAT Numbers Vatstack

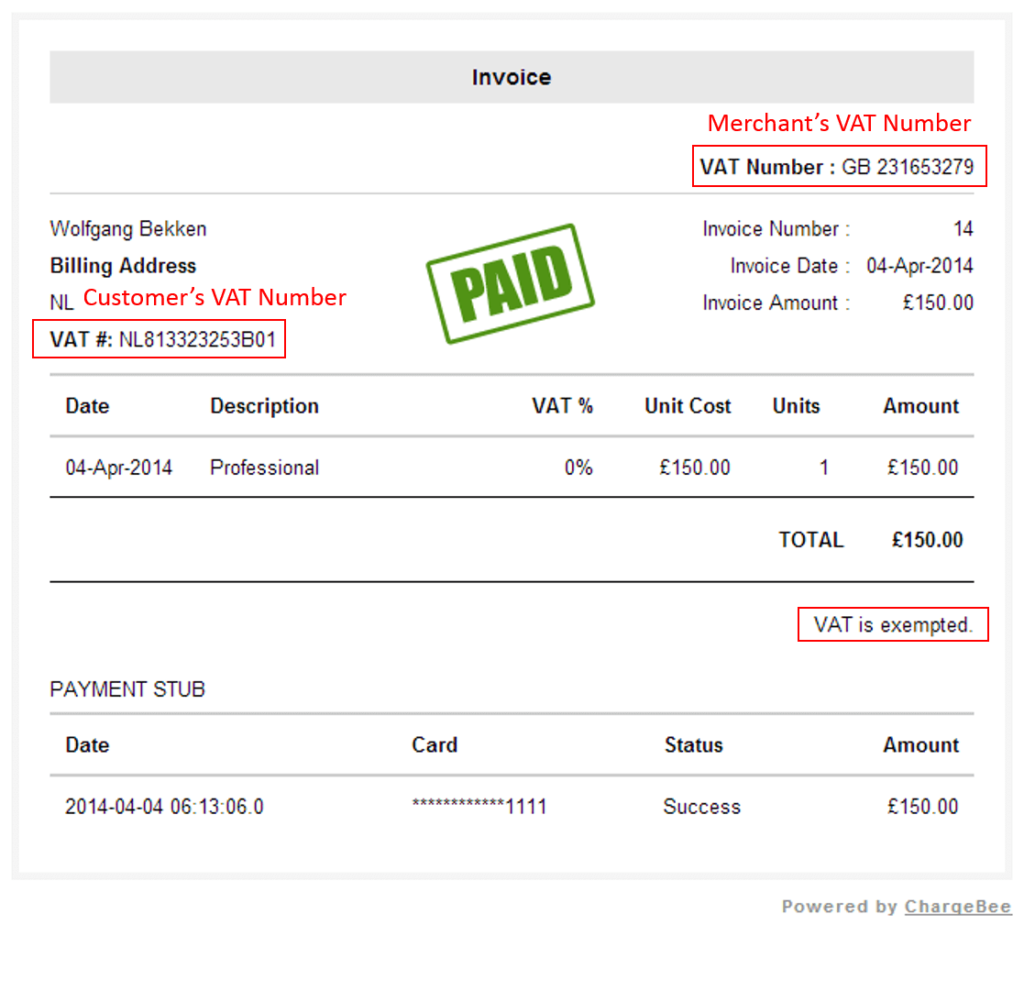

Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that is registered for VAT. Check whether a VAT number is valid. Check how VAT number is called in national language of each EU country.

European VAT Validation with PHP in real time via SOAP

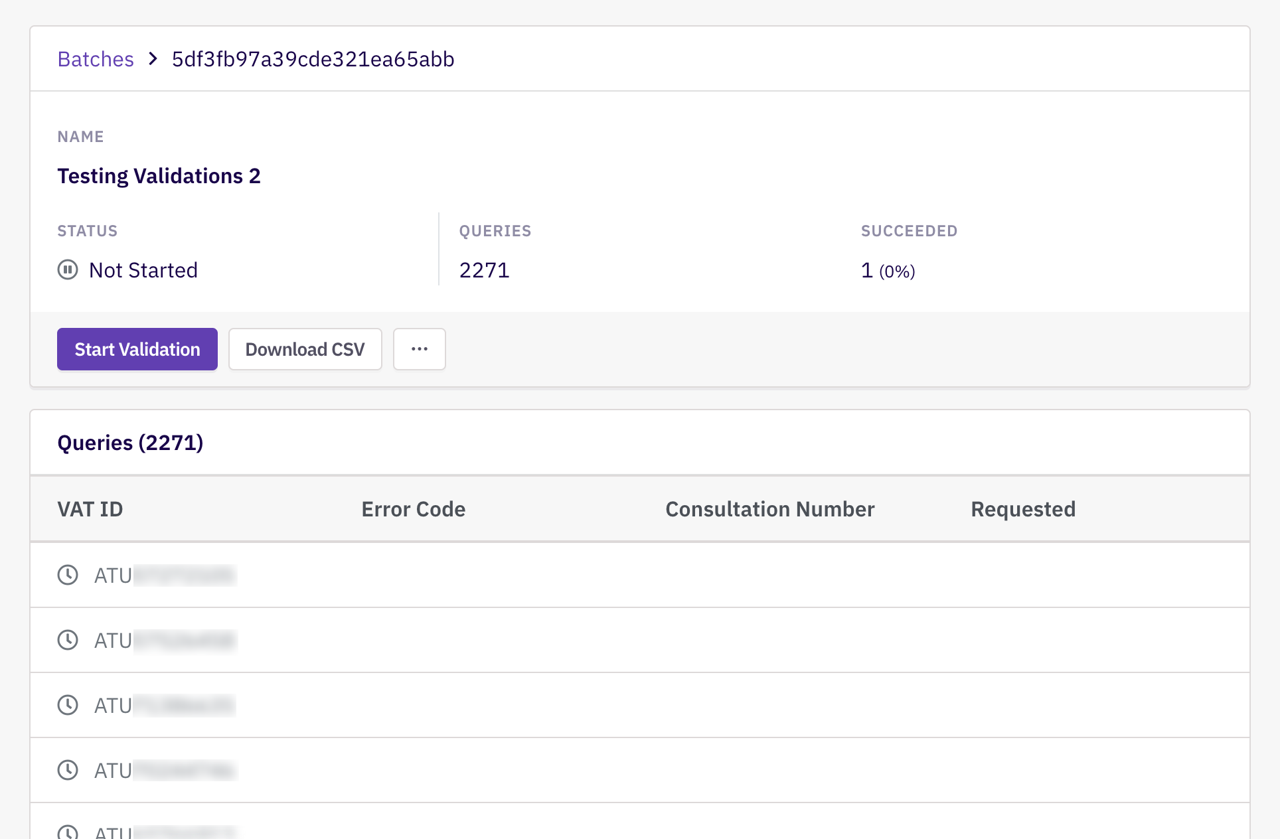

The Valdit VAT Number Validation Add-in for Excel 2016 helps you by simplifying VAT Number Checks, checking multiple numbers fast and streamlining your Compliance Processes! Always the correct address details for your customer or other data, ease of use when filling in forms, easy to implement in your applications, guaranteed fast responses.

Brexit UK VAT number validation

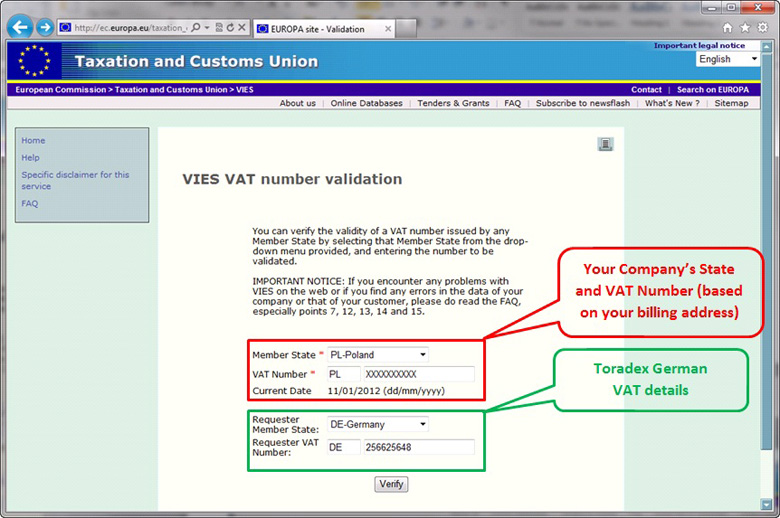

number validation in European Union. You can verify the validity of a VAT number issued by any Member State by selecting that Member State from the drop-down menu provided, and entering the number to be validated. VIES VAT number validation. Member State. VAT. Requester Member State. VAT. - or you can - go to the verification of VAT in the EU.

How to find a business's VAT number? Experlu

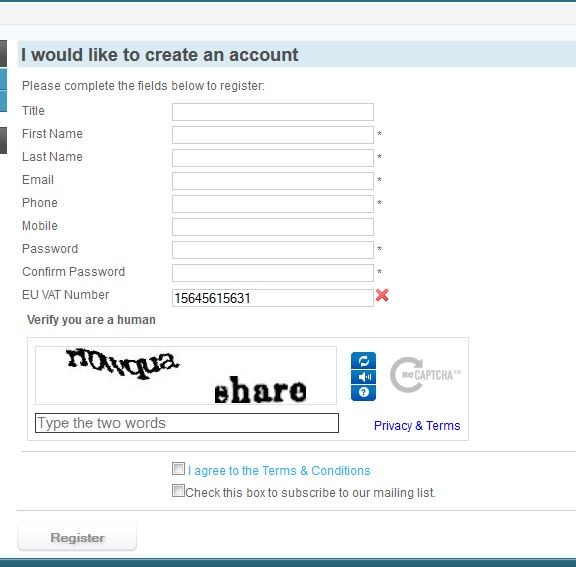

Once the obligation to VAT register has been established, the process can begin. As a basic, companies must be VAT (EU companies) or tax (non-EU companies) registered. They will then be required to complete and submit a local VAT registration form, along with supporting documentation. The application form will often be in the local language.

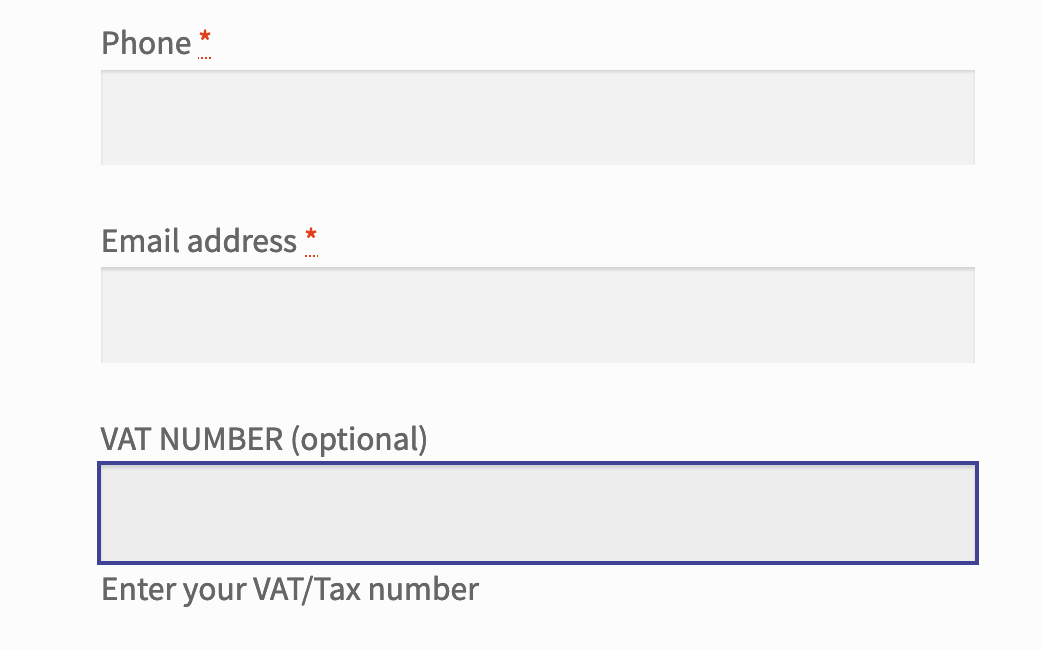

Add EU VAT number field checkout FREE plugin)

Enter VAT registration number with country code included, and if you don't know the country code, you can select it from the list. You can keep dashes, commas, spaces etc., they will be automatically cleaned. Along with EU and Northern Ireland VAT number, you can also check Swiss, Thai and Norwegian VAT registration number.

How to Check and Validate EU VAT Numbers Vatstack

When they trade goods with companies established in the EU, they receive a specific intra-Community VAT number starting with the new country code "XI" created with the Brexit. Thus, when you sell goods to a customer in Northern Ireland, he must therefore send you a VAT number that respects the following structure: Country code « XI » + 9.

VAT Sense Free UK & EU VAT Number Validation API, EU VAT rates API

The VAT Information Exchange System is an free online service that enables companies to check that other businesses that they are trading with are properly VAT registered. This EU VAT number checking is a major requirement of all companies, and can lead to investigations and heavy fines if not completed. How to degister on EU.

EU VAT Number VIES Freelance

You can check European, Norwegian, Thai and Swiss VAT numbers. To validate a single VAT number: Go to VAT number checker. Enter VAT number and submit. You must have country code, and you can keep dashes, commas, spaces etc.

EU VAT Number Plugin —

This site uses cookies. Visit our cookies policy page or click the link in any footer for more information and to change your preferences.

Europe VAT Automated VAT Number check and processing Plugins CubeCart

As of 01/01/2021, the VoW service to validate UK (GB) VAT numbers ceased to exist while a new service to validate VAT numbers of businesses operating under the Protocol on Ireland and Northern Ireland appeared.

Europe VAT Automated VAT Number check and processing Plugins CubeCart

VAT rules and procedures. Check to see if a VAT number is valid, search by EU country - either the country that has issued the number, or the country that has requested it. Check a VAT number. How to check a VAT number. There are standardised rules on VAT at EU level. But these can be applied in different ways by EU countries. VAT rules and rates.

VAT for dummies An easy guide for WordPress EDD sellers (EU and UK)

This utility provides access to VIES VAT number validation service provided by the European commission. It also supports VAT checking for countries which are not part of the EU VAT Scheme such as Great Britain and Switzerland. Example: GB731331179 for Great Britain, CHE-193.843.357 for Switzerland, NO974761076 for Norway.

How to Check and Validate EU VAT Numbers Vatstack

A computerised VAT Information Exchange System (V.I.E.S.) was set up to allow for the flow of the data held across the internal frontiers which: The unit responsible for the control of intra-Community trade in each Member State , the Central Liaison Office (CLO), has a direct access through VIES to the VAT registration database of the other.

Toradex How to validate the EUVAT number?

The VIES tool can be accessed on the European Commission's website and is available 24/7, making it a convenient and efficient way to verify the validity of a VAT number. Step 1: Input Your VAT Number and the VAT from the Company You Want to Check. Step 2: Check the results. A green indicator shows that the number is active.

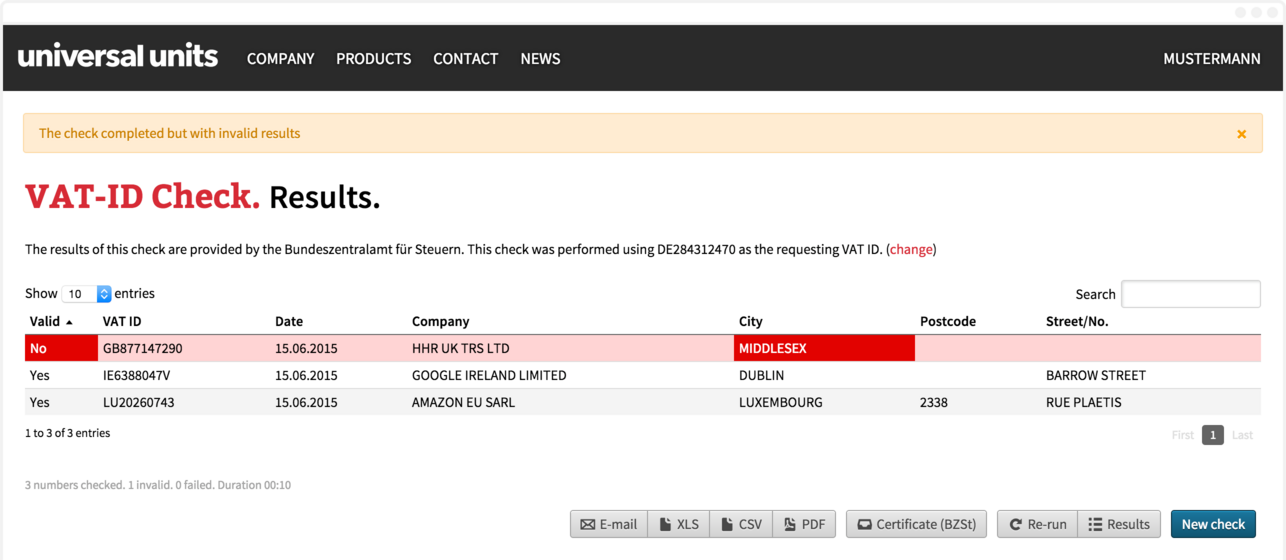

Why Is VIES Not Always The Best Solution to Verify European VAT IDs

This site uses cookies. Visit our cookies policy page or click the link in any footer for more information and to change your preferences.

.